Numbers game: D-FW's WFAA8 tightens its embrace of Rentrak as a ratings alternative to Nielsen

07/25/11 02:45 PM

By ED BARK

So just what is Rentrak?

It's not a bullet train alternative to DART. Nor is it a new website dedicated to finding affordable housing for apartment hunters.

Rentrak looms large, however, on at least one D-FW television station's radar screen. ABC affiliate WFAA-TV, distrustful of the audience numbers it's receiving from longtime titan Nielsen Media Research, is making a concerted push behind Portland, Oregon-based Rentrak's new ways of measuring eyeballs.

"Stability is what we're looking for," WFAA8 president and general Mike Devlin says in a telephone interview. "When I look at Nielsen, some days we're very smart and some days we're the village idiots."

He's talking about the ebb and flow of audience ratings based on Nielsen's sample of just 600 TV households in a North Texas market of 2.6 million households.

"It's a Mad Man technology," the equivalent of a "two martini lunch" from the expense account-fueled early 1960s, adds a WFAA8 executive who asked not to be identified.

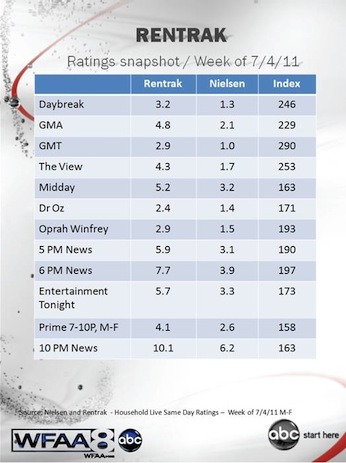

Rentrak, to which WFAA8 has been D-FW's sole subscriber for the past 10 months, measures TV viewing via set top boxes in homes subscribing to the DISH satellite network or AT&T Uverse. In this market, that's a total of 900,000 boxes in 350,000 homes, according to Rentrak. And it should be noted that WFAA8 does very well in the Rentrak numbers, with percentage ratings increases that far exceed those of its three major competitors -- Fox4, NBC5 and CBS11. More on this later, with the proviso that larger audiences go hand in hand with higher rates for advertisers.

Unlike Nielsen, no pro-active "People Meter" button-pushing is required. The boxes, already provided by DISH and Uverse, automatically measure whatever program is being watched. But over-the-air viewing by people without cable or satellite -- about 15 percent of the D-FW market -- is not included in the Rentrak ratings. (It's factored in by "weighting" the numbers, says Devlin). Rentrak also does not have contracts with some of North Texas' major subscription TV companies, including Time Warner, Verizon Fios, Charter and DirecTV. And Rentrak's data still arrives via pony express compared to Nielsen, which provides its daily numbers the following morning to subscribing stations.

Devlin concedes that measuring TV audiences accurately is "unbelievably complicated," no matter who's doing it. But Nielsen's local People Meters, which were introduced to D-FW in 2006, "have failed the original promise to provide this market with a stable, accurate and superior tool to measure television usage," Devlin told a group of local media buyers during a June 21st gathering at WFAA8's Victory Park studios in which Rentrak executives also were present. "I do not reach this conclusion lightly or with animosity towards Nielsen."

Rentrak has "approximately 75" local station subscribers across the country, according to its website. WFAA8 is the only Belo-owned TV station on board, Devlin says. "We initially just did it as an experiment. There is no other alternative to Nielsen out there."

WFAA8 increasingly is becoming a believer, though. And what's not to like? Rentrak data (the company currently provides total homes numbers and only recently added the key 25-to-54 newscast demographic) showed WFAA8 with major across-the-board audience increases. So much so that the station crushed its rivals at 5, 6 and 10 p.m. in both ratings measurements during the May "sweeps." And at 6 a.m., WFAA8's Daybreak vaulted from a distant No. 3 to a virtual second place tie with NBC5 behind frontrunner Fox4.

In the Nielsen numbers for roughly that same period, WFAA8 and CBS11 basically tied for first place at 10 p.m. in both total homes and 25-to-54-year-olds. WFAA8 won in total homes at both 5 and 6 p.m., but finished in second place behind Fox4 among 25-to-54-year-olds.

All four stations fared better with Rentrak than with Nielsen in the key 25-to-54 demographic, in which Rentrak is still perfecting its system. CBS11 was alone in losing ground in total homes, though, with smaller hauls in Rentrak than Nielsen at 5, 6 and 10 p.m. The three other stations showed gains, with WFAA8's upswings almost off the charts in some instances.

At 10 p.m in May, WFAA8 jumped from 145,298 total homes to 199,784 while CBS11 dropped from 137,514 to 124,541. And with 25-to-54-year-olds (which Rentrak currently takes a full month to measure), WFAA8's 10 p.m. viewership zoomed from 80,774 to 220,576; CBS11 showed a far more modest increase in this demographic, improving from 80,774 viewers to 118,055.

WFAA8's Devlin insists that he's "not touting Rentrak simply because we look better. I want something that's stable, predictable and has a large enough (audience) sample . . . If the entire market were to convert to Rentrak and we dropped to No. 3, I would have more confidence that there's something wrong with the newscast than I would under the Nielsen sample."

The 10 p.m. Rentrak numbers for May make WFAA8 a dominant force while pushing CBS11 from a very close second to a distant third in total homes. Even worse for CBS11, it free-falls from a first place tie with 25-to-54-year-olds to an out-of-the-money fourth.

"At 10 o'clock, we're the dominant station (in Rentrak). And we believe we are," says Devlin, discounting Nielsen number that have shown the ABC station in a prolonged battle for first place with arch rival CBS11. But why would CBS11 be the only station to show total homes decreases in Rentrak?

"They may have been the unfair beneficiary, just by chance, in the Nielsen sample," Devlin says.

CBS11 declined to comment for this story. "We don't subscribe to the Rentrak service, so with all due respect, Gary (station president and GM Gary Schneider) will pass," director of communications Lori Conrad said via email. Fox4 also declined to comment, via a corporate spokeswoman based in New York City.

NBC5 president and general manager Thomas Ehlmann was willing to talk on the record, though. In a telephone interview, he agreed with Devlin that Nielsen's sample size "is just not big enough. That's the biggest problem. The loss of three homes can cost you half a rating point. That just doesn't seem right . . . Those are the kinds of things that are frustrating, for us and for advertisers, too. You would think there would be a much better way to judge ratings than we currently have."

Although his station isn't yet a subscriber, Ehlmann said it's "kind of nice to see another company get into the ratings measurement business. They (Rentrak) seem to be getting a little bit of traction and making some progress. That's kind of the position I'm taking right now, just waiting to see what happens."

Nielsen has been down this road before, and has always been able to stare down its competitors and at least quiet its critics. In the late 1980s, a disenchanted CBS became the only network to subscribe nationally to AGB Television Research, a Great Britain-based company that went head-to-head with Nielsen. But AGB folded in 1988 after failing to land another network as a subscriber. At the time, all of the broadcast networks were reeling from sizable declines in their prime-time audiences in the face of more aggressive programming by cable networks. AGB generally showed less audience erosion for the broadcasters, and particularly for CBS.

Nielsen also has been criticized in the past by Spanish language networks who contended that Hispanics were under-represented in Nielsen's national samples. The company steadfastly stands by its numbers and methodology while also acknowledging that it's always looking for ways to improve. "People want to stick to a standard they can trust," a Nielsen spokesperson told Ad Week in response to the new competition the company is facing from Rentrak.

Ironically, Nielsen and Rentrak are partners as well as competitors. They have a long-term licensing agreement to share information on movie box office sales after Rentrak bought Nielsen's EDI business in early 2010 for $15 million. But the two companies remain rivals for now in the very big game of measuring television audiences.

WFAA8's Devlin agrees that Rentrak is still a tough sell to advertising agencies. "Is the buying community going to accept this? That's an open question," he says. "We have all become so used to Nielsen. That's the language that we use. The game is still Nielsen, and we have to deal with it."

But Devlin adds that "our jobs and livelihood are dependent on accurate ratings. And millions of dollars are spent in this market based on just 600 homes with People Meters."

WFAA8 is betting that more local stations and ad agencies -- both in D-FW and around the country -- will begin buying into Rentrak. And if that happens, Nielsen will either be pressured to make major changes, buy out Rentrak or perhaps even join forces with its latest rival.

The actual audience pull of WFAA8 and its D-FW competitors may be somewhere in between the current disparities in play with Nielsen and Rentrak. But Devlin says something has to give.

"I would sum up everything by saying, 'Someone's wrong, he says. 'Someone's very wrong.' "